Blog Post < Previous | Next >

Morningstar

Catastrophe (CAT) Bonds, a fascinating diversification investment vehicle

CAT bonds are the last line of defense backing insurers and reinsurers

Introduction

Catastrophe bonds (CAT bonds) transfer catastrophe risks from insurers to investors. They serve as an alternative or complement to traditional reinsurance, providing protection against low-probability, high-severity events that could otherwise threaten the solvency of insurance companies.

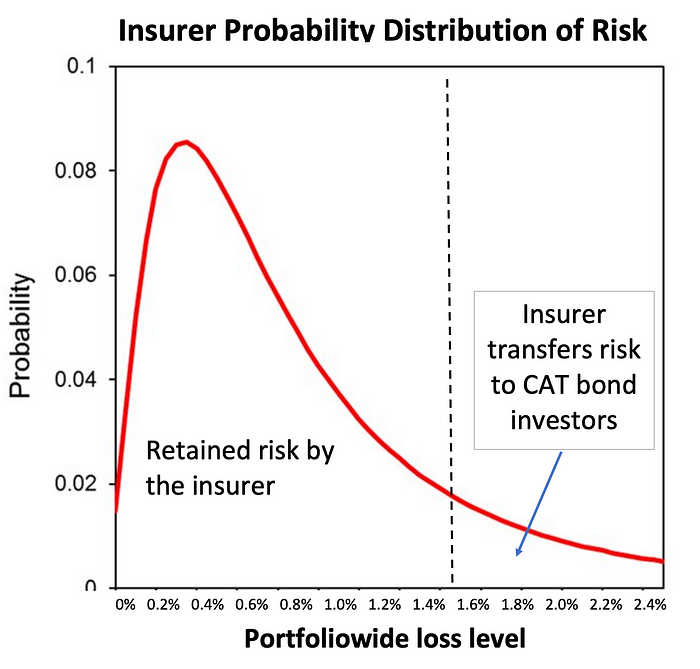

The graph below shows how an insurer manages risk in a specific property and casualty insurance portfolio. The insurer retains responsibility for losses up to 1.5% of the portfolio’s total value, which is covered by collected premiums. However, to protect its financial stability against larger losses, the insurer transfers risk above this 1.5% threshold to CAT bond investors. This arrangement shields the insurer’s financial condition from the shock catastrophes.

The above graph visually illustrates how the risk that CAT investors take on is often described as a tail risk (low-probability, high-severity risk).

Catastrophes covered by CAT bonds include mainly natural events such as hurricanes, tornadoes, floods, and wildfires. But, CAT bonds have also covered non-natural risks such as: cyber risk, pandemic risk, terrorism risk, and operational risk (major industrial accidents, critical system failures, corporate liability events).

CAT bonds emerged in the aftermath of devastating natural disasters in the early 1990s, particularly Hurricane Andrew in 1992, which highlighted shortfalls in the traditional reinsurance market’s capacity to absorb extreme catastrophe losses.

CAT bond type

We can classify bonds by:

- Peril Type: Hurricane/windstorm, earthquake, wildfire, flood, winter storm, etc.

- Geographic Coverage: US wind, Japan earthquake, European windstorm, etc.

- Trigger Mechanism: The specific conditions that must be met for a payout to occur.

Trigger types

Catastrophe bonds use various trigger mechanisms that determine when investors may lose principal:

- Indemnity Triggers (62% of the market): These activate based on the sponsor’s actual catastrophe losses, providing the most direct protection. However, they can involve lengthy settlements and introduce moral hazard — where insurers might deliberately underprice policies to gain market share, knowing they’ve transferred extreme loss exposure to CAT bond investors.

- Industry Loss Triggers (28% of the market): Based on industry-wide losses as reported by independent third parties like Property Claims Services (PCS). These offer greater transparency but introduce basis risk for sponsors. For example, if a hurricane causes $10 billion in industry losses but a disproportionate $2 billion to a specific insurer with only a 10% market share, an industry loss trigger set at $15 billion would not activate — leaving the sponsor without protection despite suffering severe losses relative to its size.

- Parametric Triggers (10% of the market): Based on physical measurements of the event itself, such as earthquake magnitude or hurricane wind speed at specific locations. These allow for rapid settlement but can have significant basis risk. For example, a parametric hurricane bond might trigger at sustained winds of 130 mph at specified locations, but an insurer could suffer significant losses from a hurricane with 125 mph winds that generates exceptional storm surge — resulting in major losses but no CAT bond payout.

- Modeled Loss Triggers (<1% of the market): Based on catastrophe model outputs using predetermined parameters. These are less common today but sometimes used for emerging market risks.

How Sponsors manage CAT Bond Basis Risk

Sponsors use several strategies to mitigate basis risk:

- Customized Weighting Schemes: For industry loss triggers, applying region-specific weights that better match the sponsor’s portfolio distribution.

- Multiple Trigger Points: Creating a sliding scale of payouts based on various measurement thresholds.

- Hybrid Triggers: Combining multiple trigger types in a single transaction.

- Detailed Modeling: Extensive analysis to optimize trigger parameters to match the sponsor’s actual loss experience.

- Multiple Measurement Locations: For parametric triggers, increasing the number and strategic positioning of measurement points.

How CAT Bonds Function

Basic Structure and Cash Flows

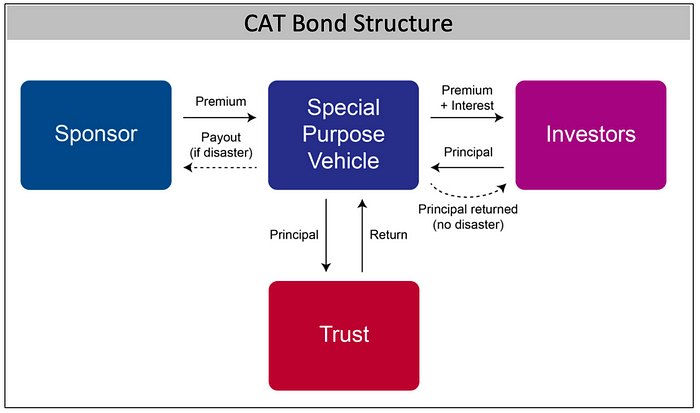

The typical CAT bond structure involves several key parties:

- Sponsor: The entity seeking protection against catastrophe risks (usually an insurer or reinsurer, but sometimes a corporation or government entity).

- Special Purpose Vehicle (SPV): A legally separate entity that isolates the transaction from other parties’ credit risks.

- Investors: Capital market participants seeking returns uncorrelated with traditional financial markets.

- Trustee: Manages the collateral account and ensures proper flow of funds.

The transaction mechanics typically work as follows:

- The sponsor establishes an SPV to issue the CAT bond to investors.

- Investors purchase the bonds, and the proceeds are placed in a collateral trust account invested in high-quality, liquid securities.

- The sponsor enters into a reinsurance contract with the SPV.

- The SPV pays periodic coupons to investors consisting of:

- Returns from the collateral investments (typically floating rate)

- Risk premium paid by the sponsor

5. If no qualifying catastrophe occurs during the risk period, investors receive their full principal back at maturity.

6. If a qualifying catastrophe occurs that triggers the bond, some or all of the principal is transferred to the sponsor to cover losses.

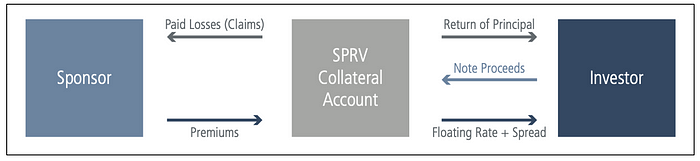

If we exclude the complexities of the cash flows with the Trust, and focus on the main cash flows between the sponsor transferring the risk to the investors, the cash flows are illustrated below.

Market Size and Development

Historical Growth

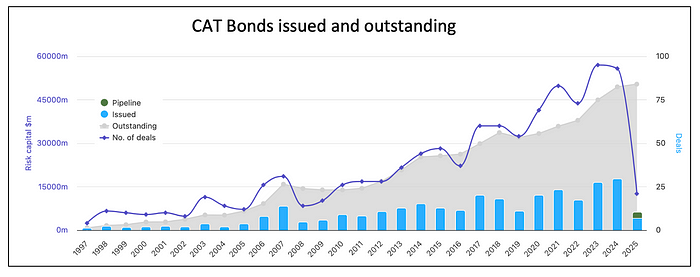

The catastrophe bond market emerged in the late-1990s following Hurricane Andrew, with the first significant issuance being USAA’s Residential Re transaction in 1997. Since then, the market has grown rapidly.

As of February 2025, the total outstanding CAT bond market reached over $50 billion. That’s over a 50% growth since 2020 ($33 billion).

Market Participants

The CAT bond market involves diverse participants:

Sponsors (Protection Buyers):

- Insurance companies wanting to transfer their risk beyond their traditional reinsurers

- Reinsurance companies seeking to transfer the risk they acquired from insurance companies onto investors

- Government entities and catastrophe funds (e.g., California Earthquake Authority, National Flood Insurance Program)

- Corporations (e.g., Alphabet/Google)

- Sovereign nations (e.g., Mexico, Chile)

Investors (Protection Sellers):

- Dedicated CAT bond fund managers (74% of market)

- Reinsurance companies (11%)

- Institutional investors (11%)

- Multi-strategy hedge funds (4%)

Notice how reinsurance companies are both buyers and sellers of catastrophe risk or CAT bonds.

Market Evolution and Trends

Several notable trends have shaped the market’s development:

- Expanding Perils and Geographies: While US hurricane and earthquake risks remain dominant, the market has expanded to cover a broader range of perils (including cyber, pandemic, and flood) and geographies (including emerging markets).

- Trigger Innovation: The market has evolved from primarily using parametric and modeled loss triggers to predominantly using indemnity triggers, enabling more precise risk transfer.

- Maturation of Market Infrastructure: Development of standardized documentation, improved modeling capabilities, and secondary market liquidity have enhanced market efficiency.

- Post-Loss Market Response: Major loss events like Hurricane Katrina (2005), Japan’s Tohoku Earthquake (2011), and Hurricanes Harvey/Irma/Maria (2017) have tested the market’s resilience and led to temporary hardening of pricing conditions.

Investment Characteristics and Diversification Benefits

Return Profile

Catastrophe bonds offer a unique return profile characterized by:

- Attractive Yields: Cat bonds typically offer higher yields than comparably rated corporate bonds due to the specialized nature of the risk.

- Floating Rate Structure: Most cat bonds pay a floating rate return (money market yield plus spread), providing natural protection against interest rate movements.

- Risk Profile: Returns are generally stable and predictable until a triggering event occurs, at which point some or all principal may be lost.

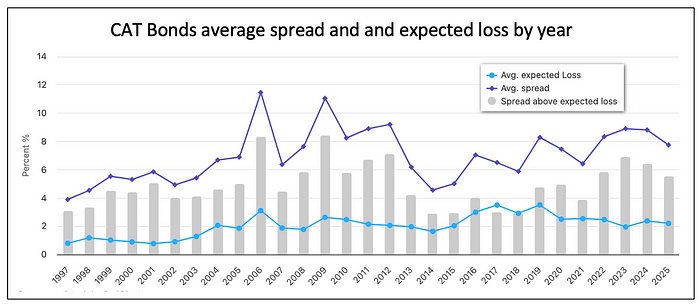

Over the 1997 to 2025 period CAT bonds have generated attractive yield whereby their respective spreads have exceeded their expected losses by over 4 percentage points in the majority of the years. Potentially earning a nearly interest rate risk free short term rate + 4% makes for an attractive bond instrument.

Later, within the Loss Experience section, we uncover that from 1997 to 2023, losses averaged 2.69%. Thus, over the long term average losses have been within a reasonable range of expected losses.

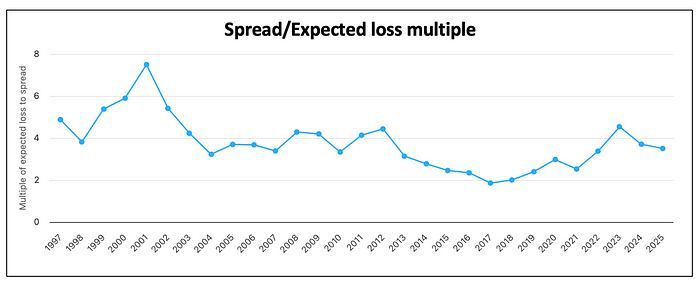

CAT bonds underwriting from an investor standpoint is pretty conservative as the bond spreads are typically between 2 to 4 times higher than the expected loss.

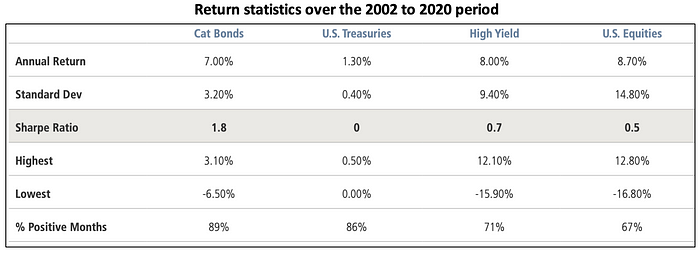

Over the 2002 to 2020 period, CAT bonds generated superior risk-adjusted returns as demonstrated by their respective low annual standard deviation vs annual return resulting in high Sharpe ratios.

Correlation Benefits

One of the most compelling investment attributes of catastrophe bonds is their low correlation with traditional financial assets. Natural disasters like hurricanes and earthquakes occur independently of economic cycles, interest rate movements, or stock market fluctuations.

This low correlation makes catastrophe bonds valuable diversifiers in institutional portfolios. Even during significant market stress periods like the 2008 Global Financial Crisis and the 2020 COVID-19 market volatility, CAT bonds have generally maintained their low correlation with broader financial markets.

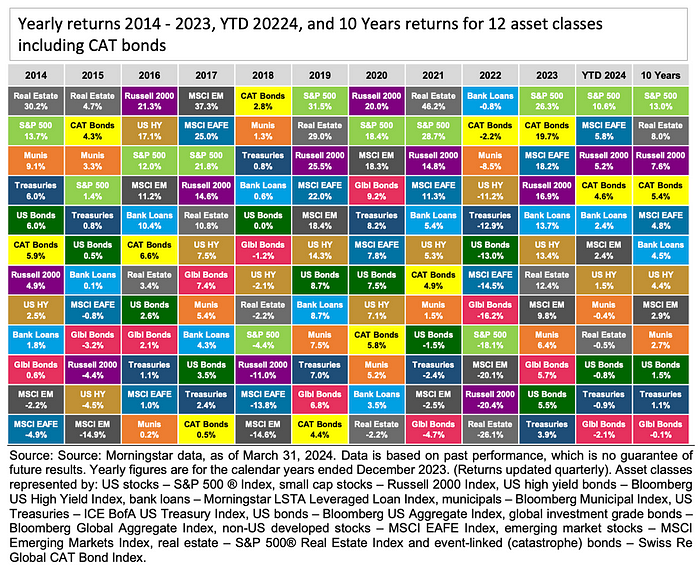

The colored table below provides another visual look at correlations and returns of CAT bonds vs 11 other asset classes. Even though it is a bit challenging to read the yearly return figure, you can readily observe that CAT bond returns (light green) have a low correlation with the S&P 500 (yellow) as when one of them ranks highly the other one does not. You can observe a similarly low visual correlation between CAT bonds (light green) and US bonds (dark green).

When focusing over a 10 year period, CAT bonds average yearly return of 5.4% is much higher than for any other type of bonds.

Loss Experience

Despite covering extreme catastrophe events, the CAT bond market has historically experienced modest losses. From 1997 through 2023, the cumulative recovery rate (losses paid to sponsors divided by total notional issued) was only 2.69%. This percentage isn’t comparable to traditional insurance loss ratios (typically 80%+) because CAT bond investors provide the principal upfront, unlike typical insurers. Instead, this 2.69% loss rate should be compared to default rates in other bond markets. When CAT bond spreads significantly exceed this historical loss rate, they can offer attractive returns similar to other fixed-income investments.

Major loss events affecting the cat bond market have included:

- Hurricane Katrina and other 2005 hurricanes

- Japan’s Tohoku Earthquake (2011)

- Hurricanes Harvey, Irma, and Maria (2017)

- Hurricane Ian (2022)

Even following these significant events, the market has demonstrated resilience, with rapid recovery of issuance volumes and investor interest.

Key Considerations for Market Participants

For Sponsors

Insurance and reinsurance companies considering catastrophe bonds should evaluate:

- Cost-effectiveness relative to traditional reinsurance alternatives.

- Basis risk implications, particularly for non-indemnity triggers.

- Multi-year protection benefits, reducing exposure to annual reinsurance market cycles.

- Regulatory capital treatment under relevant frameworks (e.g., Solvency II).

- Diversification of risk transfer counterparties to reduce concentration risk.

For Investors

Institutional investors considering catastrophe bonds should understand:

- Catastrophe risk modeling methodologies and limitations.

- Trigger mechanisms and their implications for expected loss and timing of recoveries.

- Structural considerations including collateral arrangements and extension provisions.

- Liquidity characteristics in both normal and stressed market conditions.

- Portfolio construction approaches to achieve appropriate diversification across perils, regions, and trigger types.

How retail investors can invest in the CAT bond market

The CAT bond market is primarily an institutional investor market. But, US retail investors can participate in several ways.

Dedicated CAT bonds mutual funds

Several asset managers offer mutual funds that provide retail investors with access to CAT bonds:

- Amundi Pioneer ILS Interval Fund — This is an interval fund (a type of closed-end fund that periodically offers to repurchase shares from investors) that invests primarily in CAT bonds.

- Stone Ridge High Yield Reinsurance Risk Premium Fund (SHRIX) — Another interval fund that invests in CAT bonds with quarterly liquidity.

- Securis Catastrophe Bond Fund — Available through certain investment platforms with relatively accessible minimum investments.

These funds have minimum investments ranging from $1,000 to $25,000, making them more accessible than direct cat bond investments, which often require million-dollar minimums.

ETF with CAT bond exposure

Currently, there is only one ETF dedicated specifically to CAT bonds:

Horizons Catastrophe Bond ETF (HMAX) — Listed on the Toronto Stock Exchange, this ETF aims to replicate the performance of the Swiss Re Global Cat Bond Performance Index. It provides the most direct ETF exposure to CAT bonds for retail investors.

Challenges and Limitations

Despite their attractive features, catastrophe bonds also present several challenges:

- Modeling Uncertainty: Catastrophe models have inherent limitations in predicting the frequency and severity of extreme events, particularly as climate change alters historical patterns.

- Complexity: The specialized nature of catastrophe risk and complex transaction structures create barriers to entry for many investors.

- Liquidity Risk: Secondary market liquidity can be limited, particularly during periods of market stress or immediately following large catastrophe events.

- Extension Risk: When a qualifying event occurs near maturity, bonds may be extended while losses develop, temporarily trapping investor capital.

- Climate Change Impact: Evolving climate conditions may introduce additional uncertainty into catastrophe modeling and pricing.

Future Outlook

Several factors point to continued growth and evolution of the catastrophe bond and broader ILS market:

- Climate Change Impact: Increasing frequency and severity of weather-related catastrophes may drive greater demand for risk transfer.

- Regulatory Evolution: Evolving capital requirements for insurers and reinsurers will likely continue to incentivize risk transfer to capital markets.

- New Perils and Regions: Expansion beyond traditional natural catastrophe risks to include emerging perils like cyber, pandemic, and operational risks.

- Technological Advances: Improved modeling capabilities, blockchain applications, and parametric data sources may enhance market efficiency and innovation.

- ESG Considerations: Growing interest in incorporating environmental, social, and governance factors into catastrophe bond structures and investment decisions.

Conclusion

CAT bonds have evolved from a niche innovation in the 1990s to an established component of both the global reinsurance market and institutional investment portfolios. With over $50 billion in outstanding notional and an increasingly diverse set of perils, regions, and structures, the market offers meaningful capacity for insurers seeking catastrophe protection and unique diversification benefits for investors.