Blog Post < Previous | Next >

G. Lion

The Baffling Economics of the Eyewear Business

Introduction

This is a follow-up to the Freakonomics Radio podcast “Why Do Your Eyeglasses Cost $1,000?”

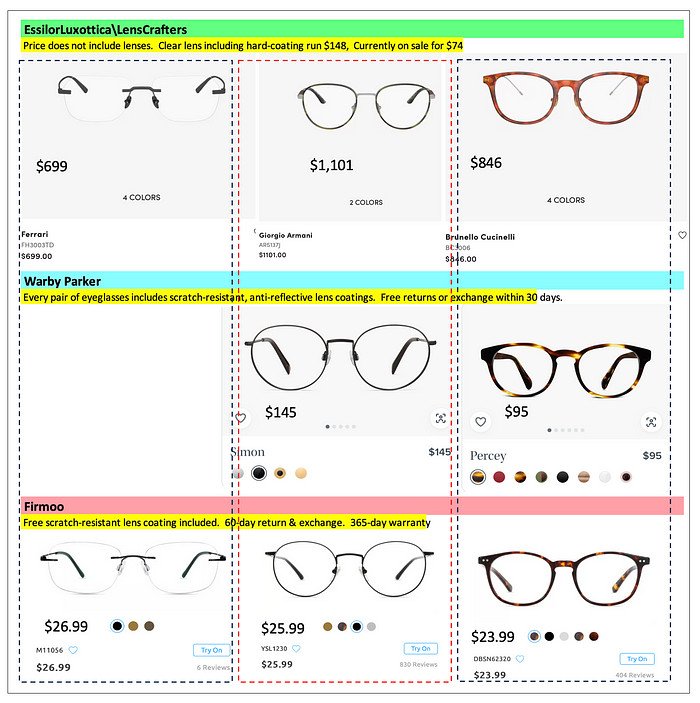

Let’s compare the price of prescription glasses from three suppliers:

- LensCrafters owned by the French/Italian eyeglasses & lenses conglomerate EssilorLuxottica (EL). LensCrafters is a window into the monopolistic world of EL because the latter owns LensCrafters and the majority of the eyeglasses brands sold in their stores.

- Warby Parker, the company that revolutionized the online prescription glasses market.

- Firmoo, one of many online prescription glasses sellers.

I will compare three frames:

a) Rimless

b) Rim metal

c) Turtle shell style

Comparative shopping

Get ready to be shocked.

As shown above in the left-hand column, you can buy rimless glasses from EL/LensCrafters/Ferrari brand for $699 + $74 to $148 for regular lenses. You can buy similar glasses at Firmoo, lenses included for $26.99! And, at Firmoo you get a 60-day return and 365-day warranty against defects. I am not aware that LensCrafters/Ferrari offers any guarantees; Meanwhile, when including lenses they cost 29 times more than Firmoo’s!

Rimless frames are the closest thing to frameless! How can EL/LensCrafters sell you three tiny pieces of metal for $700!

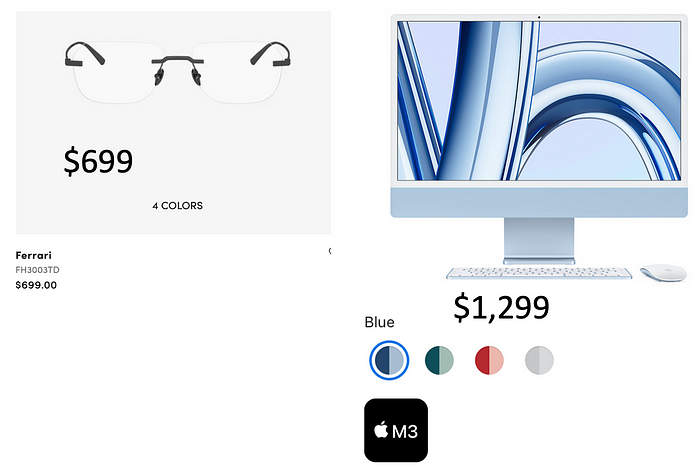

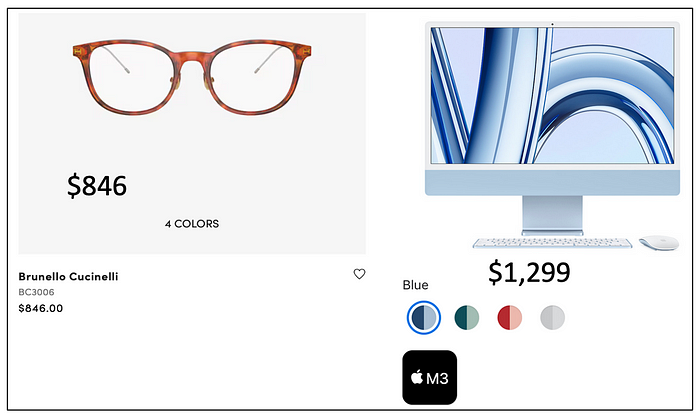

For the price of less than two pairs of EL “frameless” frames without lenses, you can buy a new IMac with the powerful Apple chip M3!

Moving on to rim metal glasses, you can go with an EL/LensCrafters/Armani pair for $1,101 (not including lenses) or a very similar model at Warby Parker for $145 including lenses and free return within 30 days or a Firmoo pair for $25.99 including lenses and the mentioned guarantees.

Regarding the turtle shell glasses, it is more of the same. See the relevant info on the picture. Notice that the Warby Parker and Firmoo turtle shell glasses look better than the far more expensive LensCrafters ones.

Many years ago, I bought several pairs of Firmoo eyeglasses. They are of excellent quality. Their prescriptions are consistent. Their frames are solid. I still use them to this day.

What can we learn from the comparative shopping?

- EL must earn extraordinary profits from its monopolistic control over its vertically integrated business. Their profit margin based on the above data alone could be as high as 95% or even more.

- EL may share some of those huge profits with some of the brands it licenses. In the podcast, they share that brand licensing deals can run from 10% to 20% of the sales price. So, on a $1,000 frame, it could run $100 to $200. So EL may have paid that much to the Armani licensor (if EL does not own this brand outright). EL still retains the majority of profits. Let’s say on a $1,000 pair, a maximum of $200 goes to Armani, $25 goes into the actual cost of the frame and lenses (see Firmoo). That still leaves $775 for EL!

- Warby Parker, even though it sells glasses for a small fraction of EL’s, should still be able to record very hefty profit margins often above 70% or so (Profit: $95 — $25 = $70; Profit Margin: $70/$95 = 74%).

- Firmoo demonstrates how low you can price high-quality eyeglasses and remain in business. The majority of their glasses including frames sell for around $25. And, they have been in business since 2009. They are not alone in this category. Zenni Optical and many other online retailers offer excellent eyeglasses for under $50.

The comparative shopping supports the podcast narrative

My short comparative shopping confirmed the mentioned podcast narrative. I am quoting below the section of the podcast that explains the EL business model.

DUBNER [host of the Podcast]:

When you say, “unit economics,” you mean what it actually costs to make a pair of frames and a pair of lenses?

BLUMENTHAL [cofounder of Warby Parker]:

Right. They [EL] were being sold for about 10x the cost to manufacture, if not … 20x. … there was wholesale markup and then a retail markup [LensCrafters] that was often 3-to-5x.

Next, I wanted to confirm these staggering profits at the company level by studying their respective annual reports.

The vast majority of eyewear businesses are private, or divisions of larger healthcare operations. Fortunately, EL and Warby Parker are publicly held; so, we can compare both companies’ financials with matching annual data going back to 2019.

The actual economics of the eyewear industry

The data sources are the respective companies' annual reports and 10Ks.

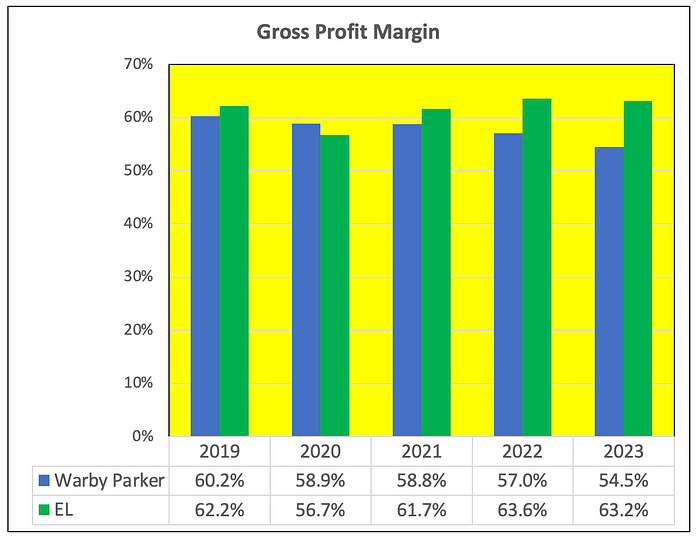

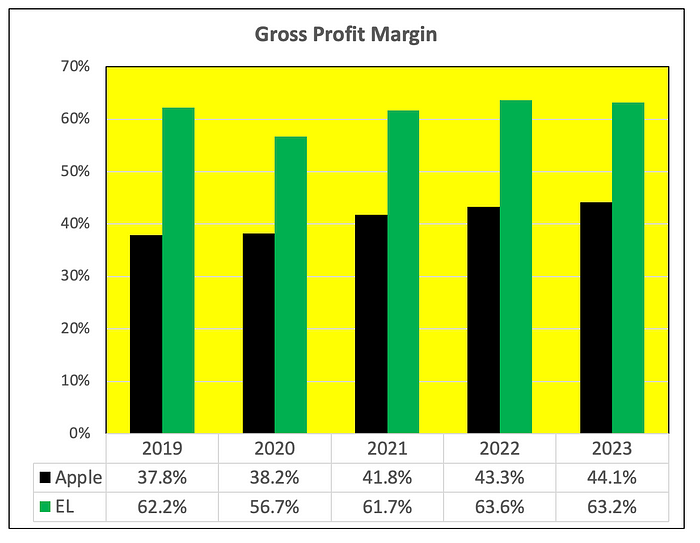

Gross Profit Margin

The graph above discloses that both Warby Parker and EL have fairly high gross profit margins in the 55% to 65% range. However, there are several surprises:

- These gross profit margins are far lower than expected.

- For EL we would have expected gross profit margins to be a lot higher. Let’s say that EL’s average glasses including lenses sell for $500. Their costs is close to $25. That would translate into a gross profit margin of over 95%. That is over 30 percentage points higher than their actual gross profit margins.

- Doing the same calculation for Warby Parker. Let’s say their average glasses sell for $100, their cost is $25. That translates into a gross profit margin of over 75%. This is close to 20 percentage points higher than their actual gross profit margins.

- Based on the above estimations, we would have expected EL’s gross profit margins to be at least 20 percentage points higher than Warby Parker’s. Instead, they are often less than 5 percentage points apart.

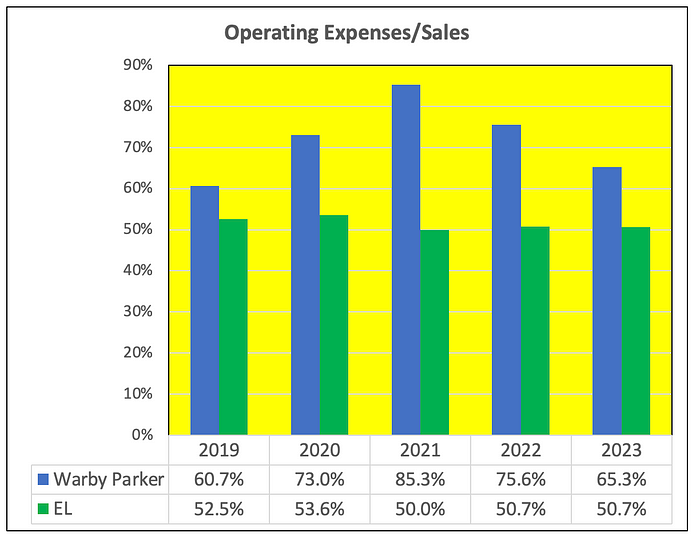

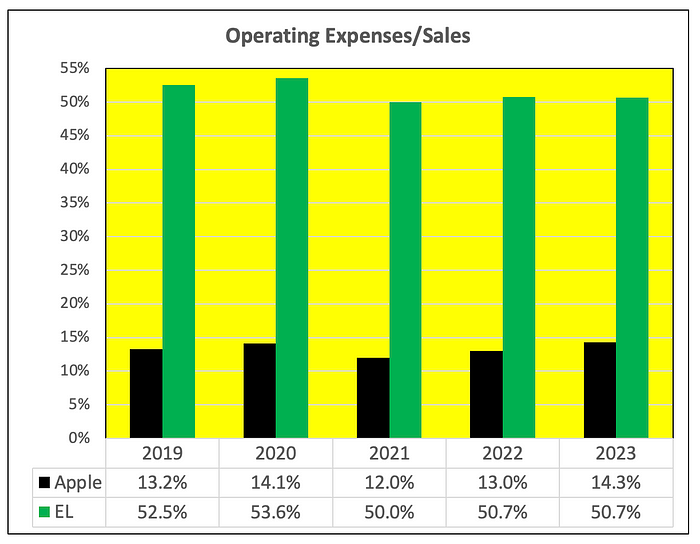

Operating Expenses/Sales

Operating expenses for both companies are surprisingly high as a % of sales. This renders the profitability of both companies far lower than suggested in the podcast.

As a caveat, EL’s lower operating expenses percentages don’t tell you that it is more efficient than Warby Parker.

Indeed, EL spends about $250 in operating expenses to sell one pair of glasses for $500. Meanwhile, Warby Parker spends only about $70 or so to sell a pair of glasses. But, because they sell their glasses for only about $100, their operating expenses represent a higher % of sales.

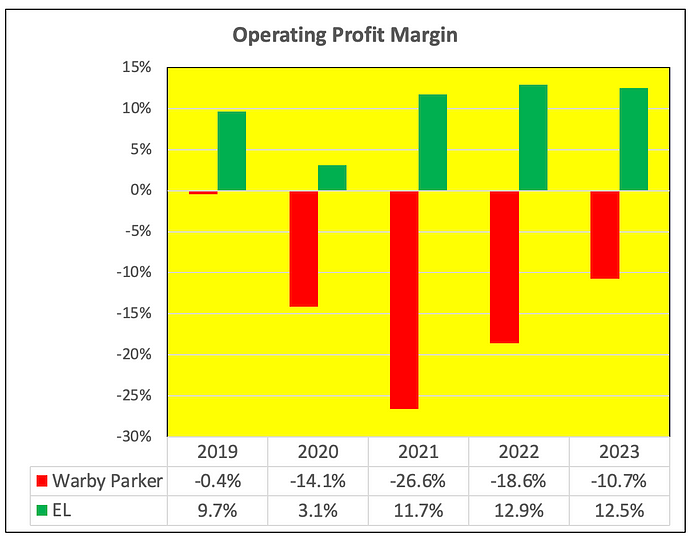

Operating Profit Margin

The operating profit margin is equal to the gross profit margin minus the operating expenses/sales.

As shown above, Warby Parker’s operating profitability performance is dismal. It is steadily losing a ton of money with operating margins that are in the red to the tune of negative — 10% to — 20%. Meanwhile, on the podcast, the founders of Warby Parker were gloating that the company was earning hefty profit margins. That’s just not the case.

EL operating profit margins are at least positive. But, they are a far cry from what one would expect from their outrageous pricing.

In the podcast, they suggested that EL was so profitable as to rival or even exceed the profitability of the Big Tech firms. Well, let’s verify this assumption. Next, we will compare EL’s profitability with Apple's.

EL vs Apple

The data sources are the respective companies' annual reports and 10Ks.

Gross Profit Margin

EL gross profit margin is about 20 percentage points higher than Apple's. One would have expected this difference to be far greater. EL sells you a few fractions of an ounce of plastic and glass for over $500. Meanwhile, Apple sells you very powerful, beautifully designed laptops, PCs, IPads, IPhones for typically $1,000 to $2,500. See another example below that outlines the absurdly high price EL glasses vs an IMac with the M3 chip.

Operating Expenses/Sales

When focusing on operating efficiency, Apple genuinely kills EL. As mentioned, on a pair of $500 eyeglasses EL would spend about $250 in operating expenses. This is much more than Apple would spend on a computer that sells for 3 times as much.

Another dent in EL’s operating performance, R & D accounts for close to 0% of EL’s operating expenses. Meanwhile, Apple’s R&D accounts for 50% of its operating expenses.

As is, EL’s operating expenses/sales ratio is more than 3 times higher than Apple’s. But, if we take out R &D, EL’s ratio would be 7 times higher than Apple’s.

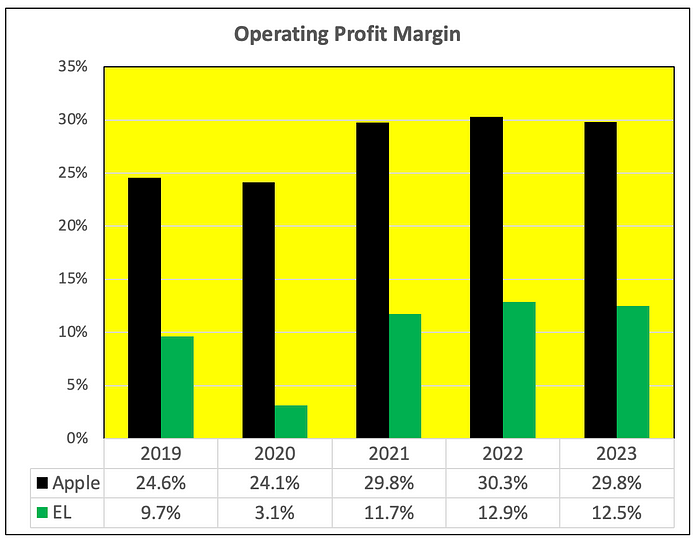

Operating Profit Margin

As shown above, Apple’s operating profit margins are routinely about 2.5 times greater than EL in good years. And, about 3 to 8 times greater in bad years (2019, 2020).

Contrary to what the guests stated in the podcast, EL is nowhere as profitable as a Big Tech company such as Apple.

THE END