Blog Post < Previous | Next >

RIA

The Great Unaffordability Crisis and Housing Costs

In the past months, we've looked at inflation, the nationwide “un-affordability” crisis, and its relationship to housing affordability. The importance of these interrelated forces cannot be understated if one wishes to understand the so-called affordable housing "crisis" in California.

This is equally important because housing rental costs represent 30% to 40% of the headline Consumer Price Index (CPI) that is watched so closely by the news and inflation-fighting agencies such as the Federal Reserve. Rental rates (and home prices), of course, vary from market to market but in general, they remain relatively unaffordable in most markets.

None of this has been helped by the recent, dramatic rise in interest rates and mortgage rates—something that has left the home buying market in a lurch. And all this is happening at a time when the average working person’s wages continue to fall and lose purchasing power.

Meanwhile, according to RIA,

“The graph below shows that real average hourly earnings are now down 3.6% yearly. This helps explain why consumer sentiment is horrendous and weak retail sales data. The average consumer took a 3.6% pay cut over the last year, whether they know it or not!”

This is supported by other data (see the charts below). Real

weekly earnings continue to fall.

Now, consider that although the “employment” (new jobs) statistics in the news say that we are creating lots of new jobs, the data is suspect.

The Bureau of Labor Statistics recently reported that the U.S. economy created 372,000 jobs in June 2022. However, noted economist Jeremy Siegel pointed out that the total number of hours worked per person per week fell, which he estimated was the equivalent of losing about 450,000 jobs. So, are we really experiencing job growth or are we treading water, hoping to avoid drowning?

At the same time, purchasing power is falling, so housing and rental costs are “rising” relative to it, even if the nominal costs remain the same.

So, what does this suggest for future housing affordability? It suggests that housing affordability can only resolve itself in one of the following ways.

Either house prices fall dramatically (deflation) or mortgage rates fall dramatically or the average worker starts to make a lot more real (inflation adjusted) income or some combination of these, which only seems possible with the advent of a severe recession.

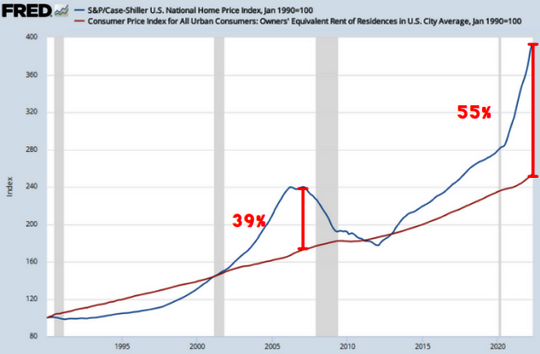

That said, it's interesting to look where housing prices are now relative to the Consumer Price (inflation) Index and where they were before the 2008 crash... and how far they’d have to fall to revert to the CPI trend line, today.

Now, some might look at these trends and conclude that this is all great news for future home buyers and renters. But, given the stag-flationary environment we appear to be heading into, not only would such a price correction take many years but in our present dynamic real wages would continue to fall even as housing prices and rental rates fall, resulting in no net advantage gained for buyers or renters.

In addition to all this being a "lack of real income" problem for home buyers and renters, the housing crisis is not so much a "lack of building" problem as it is a "lack of private capital investment" in truly affordable housing problem. Could it be that doubling down on "top down, one size fits all" policies are actually making that worse?

Meanwhile, Sacramento politicians continue to ignore all of this and cling to outdated, failed unfunded housing mandate policies and housing starts (new construction) continue to fall.

Bob Silvestri is a Marin County resident, the Editor of the Marin Post, and the founder and president of Community Venture Partners, a 501(c)(3) nonprofit community organization funded by individuals and nonprofit donors. Please consider DONATING TO THE MARIN POST AND CVP to enable us to continue to work on behalf of California residents.