Blog Post < Previous | Next >

Ikon

Inflation and Housing Affordability

The California State Legislature and the Department of Housing and Community Development continue to believe that they can will affordable housing into existence by piling on punitive regulations to strip locally elected governments of planning and zoning control while removing barriers for private, for-profit development to drive growth and disregard environmental and social justice impacts. And, ironically, they are doing this in the name of the environment and social justice.

However, they fail to recognize that housing is as beholding to the economy as everything else. And the wind is not at their back.

As noted last week (Real Wages and Affordability), even though wages, on average, are rising more than 5% a year, the American consumer is struggling to keep up with rampant inflation. (Inflation resulting from a perfect storm of uncontrollable Black Swan events: the Covid pandemic, free-for-all Federal spending in response, lockdowns and supply chain collapses around the world, an acute labor shortage, the unforeseeable war in Ukraine, and more.)

Housing affordability is just one of many victims of all of this.

There is no better evidence than the recent dramatic increase in consumer credit card debt. Even as consumers are quickly cutting back on their purchasing, credit card debt is rising at the fastest pace in 20 years.

Click on images to enlarge

This is happening at a time when the Federal Reserve is assuring us that the consumer is in “great shape” and there’s little chance of a “hard landing” for our economy. But let's keep in mind that personal consumption is 2/3rds of U.S. Gross Domestic Product… our economy.

That consumption includes home buying and all the items that go with it.

In addition to supply and demand dynamics, housing price inflation is also inextricably linked to the costs of both materials (prices for lumber, cement, etc.) and labor and the costs of doing business (insurance, taxes, etc.). Materials costs are at all-time highs (though they've stopped rising, recently) while labor costs are rising because of a labor shortage and because the industry’s workforce is demanding raises to keep up with inflating expenses for gasoline, housing, food, medical care, and just about everything else.

So, how is all this playing out?

A dangerous dynamic

Consider the chart below that shows single-family housing prices since April of last year. Notice that home prices have been rising dramatically since January of 2022.

At the same time, the number of homes sold has been dropping

just as rapidly.

As the overall cost of living increases, it erodes overall purchasing power, making people think twice about making major changes in their lives, like selling their homes. So, supply falls further adding upward pressure to housing prices.

Meanwhile, as the Federal Reserve amps up its campaign to rapidly raise interest rates (to stop inflation), this combination of market forces creates a “buyer’s panic” – prospective homeowners wanting to buy before mortgage rates price them out of the market, resulting in prices being bid up even more. We are even seeing that now in rental markets.

Of course, this phenomenon is not just limited to housing affordability. Like an economic Escher drawing, rising prices of goods and services increase the demand for wage increases, which in turn adds to the overall cost of living as companies charge more to stay profitable. This is a cycle that usually becomes self-reinforcing until interest rates rise enough to destroy growth and demand and the costs of goods and services go down and unemployment rises, or the economy falls into a recession or worse.

Obviously, none of this (i.e., rising unemployment) is good for housing affordability, either.

Things that might avoid this dire situation would be if goods and materials costs fell or worker productivity were to rise faster than wages and the rising costs of living, in real terms. However, at the time, this is not the case. According to the US Bureau of Labor Statistics, productivity has fallen to its lowest level since 1947 and the "rising wages" we keep reading about are not actually "rising."

Consider this chart showing the income history of middle-class wage earners since 1964.

In real, inflation-adjusted terms, the average weekly earnings in the private sector have not risen at all since Lyndon Johnson was president in the 1970s!

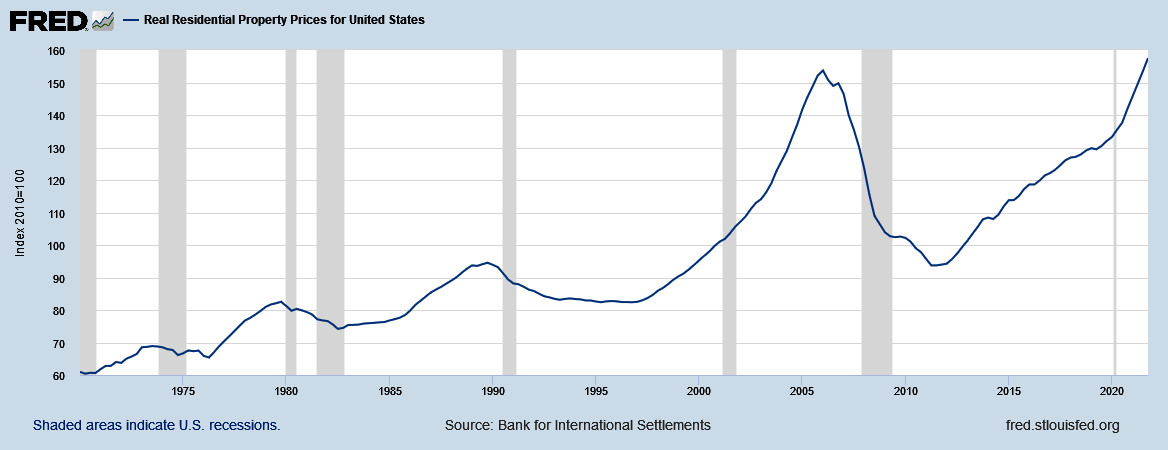

Compare this with real, inflation-adjusted housing prices, which are up 266% over the same period.

These facts complicate housing affordability, exponentially.

And California legislators wonder why housing is so unaffordable and why their punitive housing laws and absurd housing quotas are not working?

Bob Silvestri is a Marin County resident, the Editor of the Marin Post, and the founder and president of Community Venture Partners, a 501(c)(3) nonprofit community organization funded by individuals and nonprofit donors. Please consider DONATING TO THE MARIN POST AND CVP to enable us to continue to work on behalf of California residents.