Blog Post < Previous | Next >

AFP Yonhap.jpg

What, me worry? Part 2 - A Perfectly Predictable Storm

The hubris of our nation’s central bankers remains firmly in place despite the greatest financial catastrophes of the past 2 decades (the global financial crisis of 2008 and the wild predicament we find ourselves in today) having happened under their watch. To say that the Federal Reserve has a tendency to be socioeconomically “tone deaf” is an understatement.

St. Louis Federal Reserve President James Bullard recently ranted for the umpteenth time about the need to continue to raise interest rates to as high as 7% in order to beat back what he considers to be systemic, out-of-control inflation (and by inference, the somewhat resilient stock market, which the Fed wrongly correlates with a strong economy, based on its naive belief in the "efficient market theory" that is wholly discredited every time the market crashes but is always resurrected just before the next crash). Bullard justified his statement by arguing that the Fed has “been predicting declining inflation just around the corner for the past 18 months,” and they’ve been wrong.

So, based on this, we are now supposed to accept that their predictions are still wrong, and this is a sound basis for setting monetary policy?

Even though the Fed didn’t start raising rates until March of 2022 (8 months ago) because they didn’t see the inflation that was obviously coming from too much monetary stimulus (as most major economists did) and even though it is broadly acknowledged that the impacts of raising rates take 6 to 9 months to show up in the economic data the Fed tracks, Bullard is now sure that being wrong twice is the same thing as being right.

Meanwhile, it’s now unquestionable that “inflation” is falling and economic activity is declining, demonstrably, by every forward-looking indicator from the Conference Board’s Leading Economic Indicator…

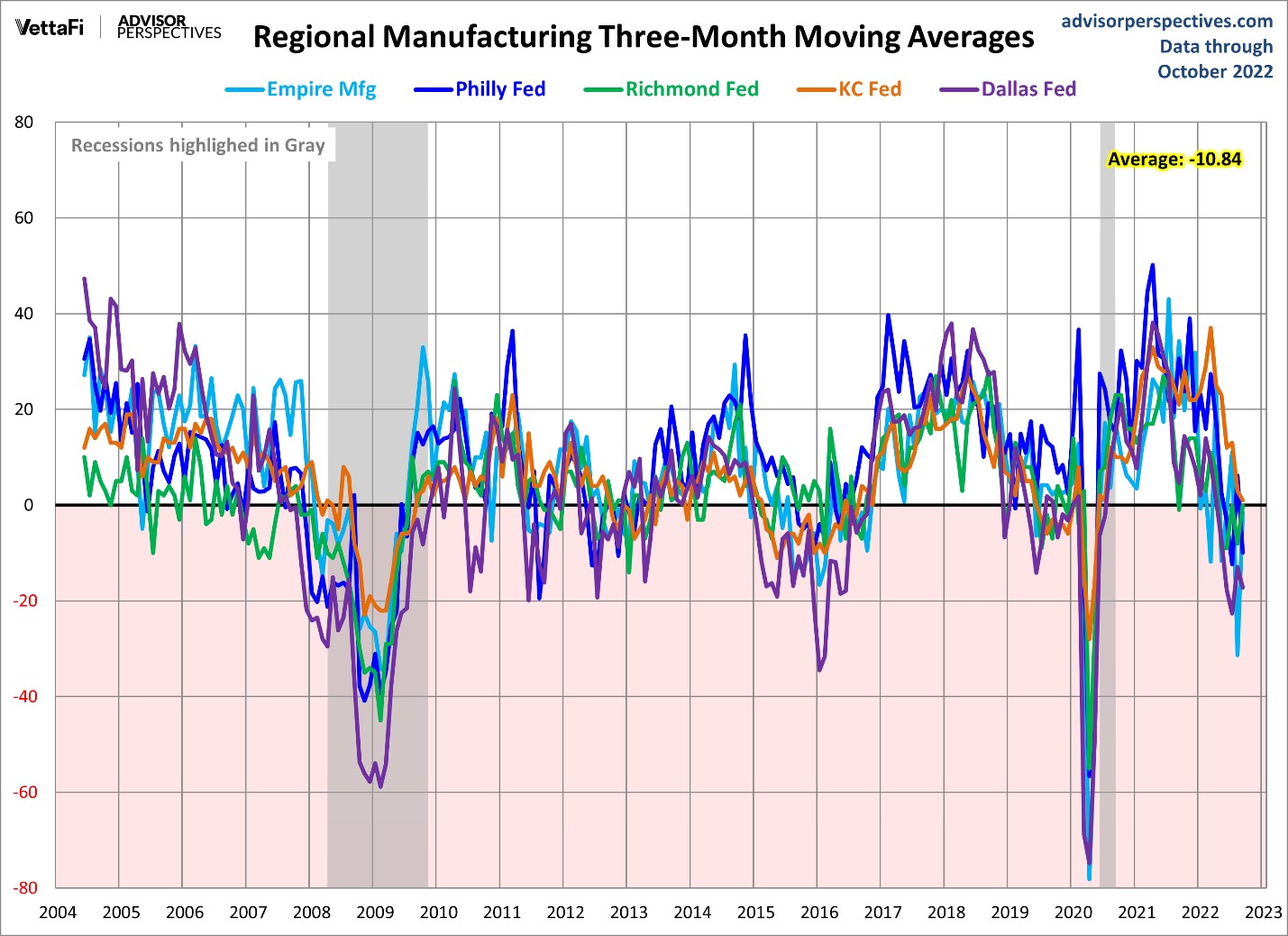

…to regional economic and manufacturing and business

activity indicators, since November of 2021.

Bullard’s pronouncements are just the latest example of how out of touch the Fed is with the lives of everyday Americans and the dire warnings coming from fundamental economic sectors, first and foremost of which is housing.

What is inflation?

To answer that question, we need to acknowledge that the mainstream media is clueless, and this includes the so-called financial news. They are freaking out that inflation is “surging” and at “40-year highs” and the price of everything is “soaring.” But as discussed in a previous article, that’s not what is happening. In fact, almost all prices stopped rising months ago and most are now falling. So, inflation is decreasing not increasing.

The trick to understanding all this is that high prices and inflation are not the same things. Inflation is the rate that prices change, not whether prices are high. Prices can be high, but inflation can even be negative.

For example, let's take gasoline prices, shown in the chart below. The media continues to claim that there is “inflation in gas prices.” However, the price of gas has fallen 26% since June of 2022 even though year-over-year inflation for the price of gas is up 10%! So, gas “inflation” (the rate of price change) has been negative since June and gas price inflation has been a flat zero percent since early September.

Similarly, the PCE Core Inflation Index (personal consumption expenditures), which the Fed says is its most closely watched indicator, just dropped to 3.6% from 6.2% on a year over year basis (a 42% drop!) in September even though it is still up about 40% from a year ago.

Still confused?

The fundamental flaw that news commentators and pundits make is to assume that “inflation” is not coming down if “prices” are not coming down. But that’s incorrect because as in the case of gasoline, Americans have been paying much lower prices than people in many other places in the world, for decades. So, maybe we were due for an upward price adjustment. As such, if the price of gas stays exactly where it is now for the next decade, gas prices will remain high but gas price inflation will be zero.

Perhaps, the question the Fed should be asking itself is how many more interest rate increases can the U.S. economy take before something more significant than FTX breaks? Miscalculations will result in impacts that the average working-class American will suffer from the most.

Inflation, the housing crisis, and the middle-class

This is a chart of new residential construction statistics in the U.S. since October 2017. Notice that new permits (the blue line in the chart below: a leading forecasting indicator) and housing starts (the dark blue line) have been falling rapidly since November 2021. The reason “completions” (the green line) are relatively steady [the green line] is that those homes were ‘pipeline projects,’ designed, financed, and slated to start before November 2021.

This chart does not bode well for new home supply in the coming years to address the much-written-about housing crisis. It also suggests that California’s Housing and Community Development Department’s aggressive RHNA housing quotas are doomed to fail.

Also, notice that the downtrend in housing permits and starts began long before the Fed realized they needed to tighten the money supply. So, the homebuilders saw what was coming while the Fed was still saying inflation was “transitory” and would be over in 2022.

Now consider this chart showing consumer sentiment about housing affordability.

The Michigan Consumer Sentiment Index has never been this low without us already being in a recession, which the Fed and our Treasury Secretary continue to assure us we are not currently in.

Or how about this chart showing mortgage applications?

According to its author, this chart shows the biggest yearly drop in mortgage applications ever recorded.

Maybe, the Fed can explain how raising rates higher and higher, which will produce lasting damage to our economy and increased social unrest, is warranted in the face of what these data are telling us.

How raising interest rates increases inflation in the short term

The Fed seems to be clueless about how inflation affects prices and inflation rates in the short term versus the long term. The minute the Fed started talking about raising interest rates, in early 2022, every major business in every major economic sector immediately started to raise prices. Why? Because the markets value companies based on their earnings.

Predictably, the corporate reflex is to quickly ramp up borrowing at low rates, while they last, and to raise prices so that earnings “growth” remains high, which the market will reward with higher stock prices, (for companies that can raise prices like oil companies) thus offsetting the “value” decreases from the increased debt liabilities. Of course, in most cases stock prices still fell because most companies could not raise prices enough and the magnitude of the rate increases coming off set any benefits.

But, initially, raising interest rates threw gas on the fire and increased price inflation. That is why we saw prices (and the inflation rate) rise rapidly after the Fed started saying they needed to raise rates in late 2021 and early 2022. However, this “surge” in inflation was temporary and peaked in the summer of 2022.

Since then, in order to keep reported earnings up, corporations have started to cut back investments, sell off assets and less profitable business endeavors. Now, finally, they are laying off employees and canceling new expansions and capital good investments to support their stock prices (because their financial liabilities are reduced). All this has not helped avoid a bear market but it's helped the markets avoid the total, doomsday collapse that many market pundits have been predicting.

But now, companies can’t raise prices anymore because consumers are cutting back on spending, and they've exhausted all other options (hopefully other than cooking the books). So, the bad news has been coming out and some will be forced to head into the bond default, bankruptcy, and liquidation phase. Sometimes this process can take as much as a year.

However, none of this is inevitable unless monetary tightening is continued far past the time it’s needed. But the Fed continues to think rates need to go higher because they are oblivious to the way these transient, statistical mirages play out and this time, when the economy’s momentum finally turns down, it will be very hard to stop. And inflation can flip to deflation.

To make matters worse, the pandemic-produced, supply-chain-driven type of inflation we’re experiencing cannot be solved by ever more restrictive monetary policy (this is not the 1980s). It needs to be complimented by government economic policy (e.g., Why didn't we have had price controls on oil companies in January 2022, instead of allowing EXXON to book record-breaking profits this year?).

The Fed is either too dumb or too cowardly to come out and demand this.

But then, none of the Fed Board Members or Fed Bank presidents look like they’re hurting, financially, no matter what happens. So, maybe it’s just not on their personal radar as being a problem. Does that sound like a cheap shot?

I'm not so sure. This reminds me of when Fed Chairman Greenspan was telling us all that there would be no “contagion” to the stock markets from housing mortgage defaults, in the summer of 2008 (two months before the biggest financial collapse since the Great Depression), while he owned zero shares of stock and was 100% invested in Treasuries. He didn’t believe anything bad was coming because nothing bad would happen to him, either way.

The ongoing diminishment of the middle class

As reported by RIA, “according to Pew Research, the share of adults who live in middle-class households fell from 61% in 1971 to 50% in 2021.” And the total, per capita income share of the bottom tiers fell faster while the upper tiers rose faster.

“The shrinking of the middle class is accompanied by an increase in the share [of all income] of adults in the upper-income tier, which increased from 14% in 1971 to 21% in 2021. At the same time, there was an increase in the share [of all income], who are in the lower-income tier, from 25% to 29%.”

The share of the country’s total overall income for 80% of the U.S. population (the blue line) has fallen behind the share that goes to the top 20% of the population (the red line). Now, the heart of the U.S. “affordability” crisis (which includes housing affordability) comes into clear focus. Most people just can’t keep up.

Still, the out-of-touch Federal Reserve keeps assuring us that the “consumer” is doing fine (which is an important thing because about 70% of our economy / GDP is based on consumer spending). So, what gives?

Well, it all depends on how you interpret this chart.

A normal person would interpret this chart to be saying that consumers are heading for a brick wall because they are exhausting savings (the blue line dropping to a historical bottom) and going deeper and deeper into debt (the red line soaring). But not the Federal Reserve. They say this means the economy needs to be beaten down so consumers stop buying because that “demand” is driving up prices and inflation.

Once again, the Fed can’t see the forest for the trees. Whereas, in past rising consumer debt cycles, when consumers were buying on credit for discretionary items because they were feeling confident in their future, now the items increasingly being paid for on credit are food, rent, healthcare, and utilities (to have the "luxury" to stay warm).

So, the $64,000 question is, when do we reach the tipping point when the whole thing starts to fall under its own weight, and the increases in interest rates make it impossible to refinance our debt at lower rates, or take out second mortgages or lines of credit to pay off credit card debt?

Add this to the other impacts of rate hikes shown in the previous charts, and the picture it paints does not portend a stable, socioeconomic future.

Maybe the Fed needs to accept that we can't fix the consequences of the past 40 years of "supply-side," trickle-down, debt-driven, unsustainable growth overnight and a more measured approach is called for?

Bob Silvestri is a Marin County resident, the Editor of the Marin Post, and the founder and president of Community Venture Partners, a 501(c)(3) nonprofit community organization funded by individuals and nonprofit donors. Please consider DONATING TO THE MARIN POST AND CVP to enable us to continue to work on behalf of California residents.