Blog Post < Previous | Next >

MVSD

The Mill Valley School District's (MVSD) Dire Financial Situation

Abstract

The Mill Valley School District (MVSD) faces a severe financial crisis driven by declining enrollment and unsustainable expenditure growth. Between 2019 and 2024, the district experienced a 20% decrease in student population, with realistic projections based on historical demographic trends suggesting continued decline through 2027. This demographic shift reflects broader aging trends across Marin County, where multiple elementary school districts face similar challenges.

In January 2025, MVSD received a "Qualified Certification" from the Marin County Superintendent of Schools, indicating it could not maintain the required 3% minimum reserve balance over the next three years. Without intervention, the district risks State takeover within this timeframe.The crisis emerged during the 2024 school year when expenses exceeded revenues by $6.2 million, depleting 25% of reserve funds. The situation worsened in 2025, with projected losses of $7.8 million.

Several factors contributed to this financial deterioration. While MVSD cited a 10% salary increase and $6.2 million reduction in COVID funds as primary causes, analysis reveals broader systemic issues. Every expense category increased significantly during the 2024 school year, with total expenses rising 18.5% ($9.3 million) while revenues remained flat. The expense-to-revenue ratio deteriorated from 94.5% during the 2023 school year to an estimated 114.1% in the 2025 one.

MVSD's turnaround plan includes drastic 9% expense reductions, eliminating 41 positions, and implementing a two-year salary freeze. However, these measures face substantial challenges, including potentially unrealistic demographic assumptions and likely resistance from the Mill Valley Teachers Association regarding salary freezes.

Additionally, MVSD had cancelled its Transitional Kindergarten (TK) program, which served 150 children at $14,666 per child. While parents temporarily saved the program for the 2026 school year by raising $1.5 million, this funding approach is unsustainable. Future options include potential state support through proposed legislation (AB 1391) or local funding through a parcel tax, which would require either 66.6% voter approval or a citizen initiative needing signatures from 5% of district voters.

The article also explores potential consolidation scenarios, noting that MVSD's continued independence may be unsustainable given demographic trends. Potential options include merging with other elementary districts or unifying with the Tamalpais Union High School District to create a K-12 institution serving approximately 7,000 students. Such consolidation could provide economies of scale and access to more favorable funding mechanisms, as unified districts, given their larger size, typically benefit more from California's Local Control Funding Formula when classified as a Non-Basic Aid District.

Let's first review the MVSD demographic situation which has material financial implications.

Demographic situation

There are numerous demographic metrics of students counts including average daily attendance and enrollment in either October or at the end of the school year.

All above metrics tell you the same thing. Between June 2019 and June 2024, students' counts have decreased by more than - 20%. The above is associated with Marin County's advanced demographic aging. MVSD has projected average daily attendance out to the 2027 school year (ended June 30, 2027) to remain flat at 2,238.

Looking at the demographic history, MVSD's projections appear highly optimistic. The table below discloses the annual % decline in average daily attendance going back to 2019.

If we reconstruct an optimistic scenario, that the average daily attendance declines by only - 1.5% a year, the lowest decline in the history of the data going back to 2018- 2019, the projected average daily attendance in the 2027 school year would be 2,103. If we now explore different scenarios ranging from - 1.5% to - 3.5% decline per year, we get the following average daily attendance in the 2027 school year:

Notice that the - 3.50% scenario contemplated above represents the historical median. So, it is by no means any type of stressed scenario. It just confirms that the - 3.50% falls within realistic ranges of what could happen.

The ongoing and prospective decline in average daily attendance raises a question whether the MVSD can remain independent. Marin County has 12 elementary school districts. Given that Marin County's population is expected to continue declining and aging, most of these elementary school districts are experiencing similar demographic trends. Indeed the table below shows that enrollment has decreased rapidly for the majority of such districts within Marin County.

Given the ongoing decline in enrollment, it is not unlikely that several elementary school districts will have to merge over the next decade.

Another option for the MVSD would be to merge with the Tamalpais Union High School District (TUHSD). A MVSD - TUHSD merger would create an attractive integrated institution that would cover the whole range of grades from K to 12.

Does it make sense to have separate administrative management functions for two school districts with headquarters less than a mile away?

A merged elementary and high school program into a single institution is most common and is called "Unified." Such Unified Districts account for the largest districts in California.

A potential merger between MVSD and TUHSD into a Unified District serving approximately 7,000 students would still place the district on the smaller end compared to the top 20 Unified Districts listed above. However, such a move would allow the new district to realize meaningful economies of scale and unlock more favorable funding mechanisms than either district can access independently.

Currently, most elementary districts in Marin County are very small—some no larger than a single traditional school, and in some cases, closer in size to a single college or even a high school classroom. Enrollment across these districts continues to decline, compounding operational and financial challenges.

From a governance perspective, unification could be a strategic move. Larger districts are typically better positioned to benefit from the State’s Local Control Funding Formula (LCFF), especially when reclassified as Non-Basic Aid Districts—a key funding distinction explored in the following sections.

The ongoing decline in enrollment has direct financial consequences. Under the LCFF, district funding is partially based on average daily attendance. Districts must also choose between two funding classifications: Basic Aid and Non-Basic Aid. This decision significantly impacts how much revenue is generated from State funds versus local property taxes. Ultimately, enrollment levels play a central role in determining the most financially advantageous path forward.

LCFF in Basic Aid vs. Non-Basic Aid Districts

Basic Aid Districts: These districts generate enough local property tax revenue to exceed their LCFF target funding level. They do not rely on state aid to "fill the bucket" and instead keep any excess property tax revenue beyond their LCFF entitlement. Basic Aid districts receive minimal state funding—$120 per student—and have greater financial flexibility due to their high local revenue.

Non-Basic Aid Districts: These districts rely on a combination of local property taxes and state aid to meet their LCFF target funding level. If local property taxes fall short, the state provides additional funds to reach the target amount. These districts are more dependent on state funding and are subject to LCFF formulas for supplemental and concentration grants.

In summary, while the Local Control Funding Formula (LCFF) is applied consistently throughout California, Basic Aid districts operate differently. These districts generate more local property tax revenue than the LCFF funding target, allowing them to keep the excess and rely less on state funding. In contrast, Non-Basic Aid districts receive state aid to meet funding levels determined by student needs.

This distinction is often seen as a divide between wealthier (Basic Aid) and less wealthy (Non-Basic Aid) school districts. However, it's more nuanced—it’s really a matter of numbers. A district with a large and growing student population can often benefit more from being a Non-Basic Aid district, as it receives substantial per-student funding from the state, even though it's limited in how much property tax revenue it can keep.

On the other hand, districts with fewer than 3,000 students may lack the economies of scale needed for LCFF funding to be sufficient. For example, Mill Valley School District (MVSD) was once a Non-Basic Aid district, but due to declining enrollment, it shifted to Basic Aid status in 2019. At that time, facing financial challenges, it also had to eliminate its transitional kindergarten (TK) program.

With rapidly declining enrollment and rising cost, the cost per enrolled student has risen rapidly since the 2019 - 2020 school year.

The above provides perspective on how much it costs per student (K - 8) when comparing the public MVSD with private schools. It is no surprise that private schools have to charge a lot to break even.

The MVSD Financial Crisis

First, let's review the different regulatory status of a school districts' financial soundness.

California school districts are required to submit interim financial reports twice a year, certifying their ability to meet financial obligations for the current fiscal year and the subsequent two years. These certifications are categorized into three statuses: Positive Certification, Qualified Certification, and Negative Certification. Each status reflects the district's fiscal health and has specific implications.

1. Positive Certification

Definition: A Positive Certification indicates that the district is projected to meet all its financial obligations for the current fiscal year and the next two years.

Implications: The district is financially stable, with no significant risks to its operations.No additional oversight or intervention is required. This status allows the district to operate normally and focus on educational priorities without immediate financial concerns.

2. Qualified Certification

Definition: A Qualified Certification means that the district may not be able to meet its financial obligations in one of the next three years.

Implications: It serves as a warning sign of potential fiscal instability, requiring careful monitoring and adjustments to expenditures. The County Office of Education (COE) must notify both the district governing board and the State Superintendent of Public Instruction about this status. While immediate changes to educational programs or services are unlikely, district leaders must take steps to restore long-term fiscal health, such as reducing expenditures or seeking additional revenue sources.External reviews or technical assistance may be triggered to address financial risks.

3. Negative Certification

Definition: A Negative Certification signifies that the district cannot meet its financial obligations in the current fiscal year or the next one.

Implications: This is a serious situation requiring immediate action to avoid insolvency. The COE notifies the State Superintendent, and interventions such as appointing external advisors or state administrators may occur. The district may need to make significant cuts to programs and services, potentially impacting students and staff. The state can take over financial leadership of the district, prioritizing repayment of funds loaned by the state over local governance decisions.

On January 15, 2025, John Carroll, Marin County Superintendent of Schools, sent a letter to MVSD indicating that it's financial condition was classified as "Qualified Certification" because it could not meet its obligation to maintain a minimum general fund reserve balance of 3% of general fund expenditures over the next 3 school years. John Carroll disclosed the following financial data stressing this issue.

The above graphs are representative pictures of a school district experiencing a financial crisis. Indeed, it shows that based on the most recent projections at the time, it would nearly wipe out its entire reserve balance within two and a half school years. At such point, the State could take over control of the MVSD. The latter has 75 days to respond and submit an updated set of financial projections indicating how it will maintain its reserve balance above the 3% threshold over the next 3 school years.

Within his letter John Carroll outlined the restrictive terms governing a School District falling under the "Qualified Certification" status.

While the MVSD continues to hold a AAA long-term bond rating, it’s important to understand why. Rating agencies base these high ratings largely on Marin County’s strong socioeconomic profile—specifically, its wealth, high property values, and consistent voter support for public initiatives. However, despite these favorable external factors, they have not shielded the MVSD from a troubling financial trajectory that could ultimately lead to insolvency and potential State intervention within the next 3 years.

When did the MSVD Financial Crisis first hit?

According to MSVD as disclosed in the Marin IJ article, "Mill Valley School District faces 'unexpected' $7.3M budget deficit", this crisis emerged unexpectedly in January 2025. However, reviewing the MVSD financials, we can see that this crisis hit a lot earlier than that.

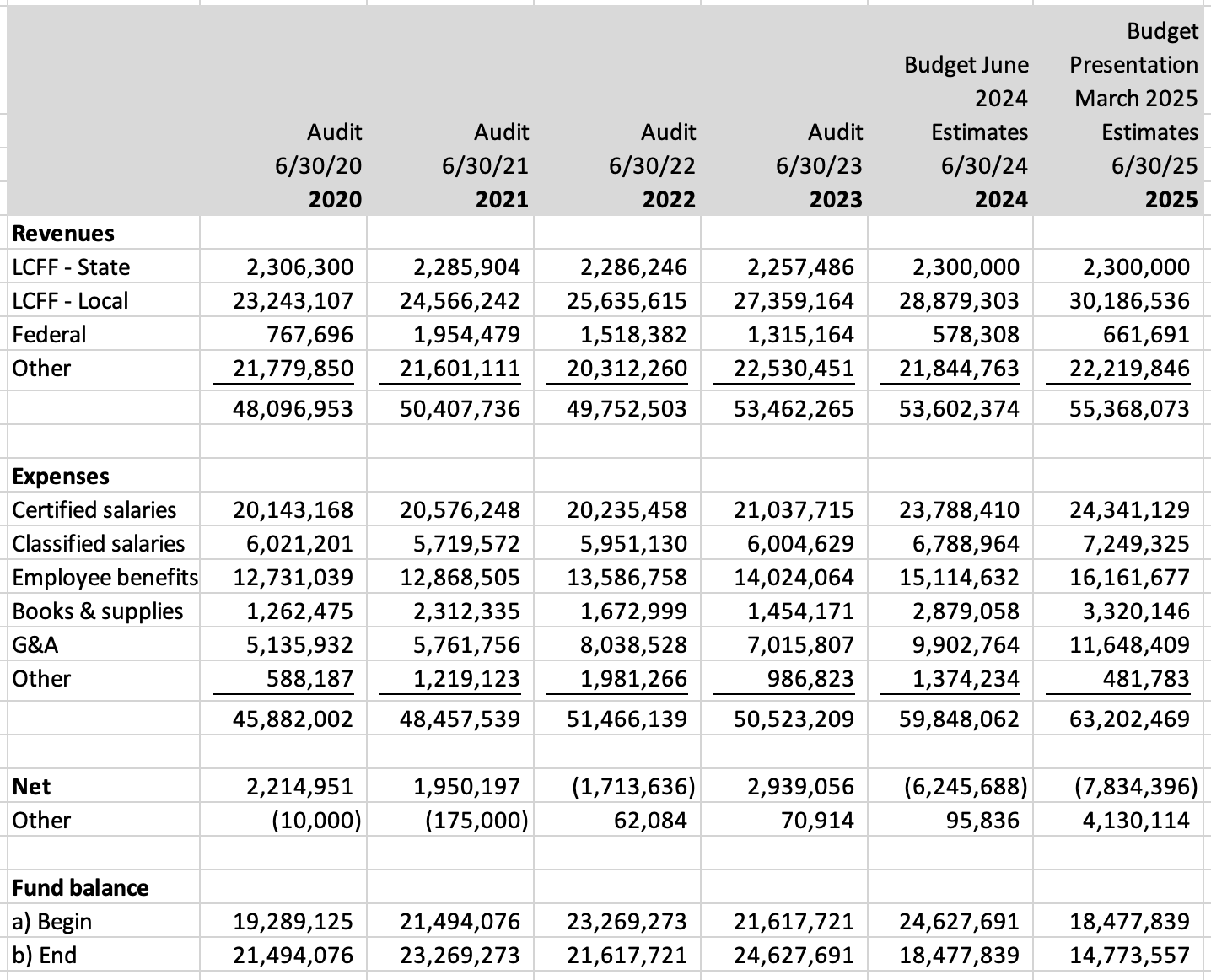

Reviewing the financials over the most recent years, you can see that MVSD's financial crisis hit during the 2024 school year (ended June 30, 2024). During this year, expenses were estimated to exceed revenues by $6.2 million and wipe out 25% of the reserve fund balance. The MVSD published these figures on June 7, 2024. But, the Marin IJ and the MVSD uncovered and disclosed this financial crisis a full 7 months later. And, this financial crisis is ongoing. After incurring an estimated net loss of $6.2 million during the 2024 school year, the MVSD is anticipating an even greater loss of $7.8 million during the 2025 school year ending this coming June 30th.

Given current financial trends, it is evident that the MVSD cannot sustain operations in its current form for much longer. Without timely and strategic intervention, the District faces a significant risk of falling under State control within the next three school years—or potentially sooner.

This current crisis really hit during the 2024 school year. So, let's give it a closer look.

MVSD mentioned that a 10% increase in salaries' levels and a $6.2 million cut in COVID funds was responsible for the situation. Within the table of expenses above you can clearly see the impact of the 10% increase in salaries' levels that translated into a 13.1% increase in overall salaries expenses during the 2024 school year (ended June 30). However, the $6.2 million in COVID funds cuts must have been amortized over several years. The estimated impact of such cuts seemed to be only $700,000 per year during the 2024 and 2025 school years (go back to the complete income statement and focus on the 'Federal' line).

Reviewing the expense figures, we can see that every expense category played a material role. Salaries and benefits combined accounted for $4.6 million of the rise in expenses. However, all the other costs represented an even larger $4.7 million increase in expenses. In other words, this is not just about the 10% increase in salary levels. Every single expense category experienced massive increases. For instance, the cost of books & supplies nearly doubled from $1.45 million during the 2023 school year to $2.88 million during the 2024 one.

During the 2024 school year, total expenses rose by 18.5% or $9.3 million. Thus, total expenses rose from $50.5 million during the 2023 school year to $59.8 million during the 2024 one. Meanwhile, revenues remained flat.

Focusing on the trend in expenses as a % of revenues, one can see that recent trends are unsustainable. Indeed, expenses rose from 94.5% of revenues during the 2023 school year to an estimated 114.1% in the current 2025 school year.

Again, the financial crisis hit during the 2024 school year. As shown below every single expense category accounts for a much larger % of revenues during the 2024 school year vs the 2023 one.

As shown earlier, the situation continued to deteriorate during the 2025 school year, as expenses are estimated to rise from 111.7% of revenues during the 2024 school year to 114.1% in the 2025 one.

To avoid the MSVD being eventually taken over by the State within less than 3 years, the MVSD has come up with a turnaround plan.

The MVSD Turnaround Plan

In a presentation dated March 6,2025, the MSVD presented their Turnaround Plan (attached at the end of this article). It disclosed the following projections.

If you calculate the difference between revenues and expenses, you derive net losses that are nearly $1 million greater in both the 2025 and 2026 school years as shown in the table below.

The above discrepancy results in a large discrepancy in projected change in the general fund balance.

The above is hopefully not an addition error. It may be due to undisclosed and unexplained non operating sources of funds. These do occur within MVSD financials. For instance, during the 2025 school year, the MVSD benefited from an unexplained non operating $4.1 million fund injection. You can see it within the income statement near the beginning of this article under the line "Other" under Net.

The MVSD is taking draconian measures to cut their expenses by 9% or from $63.2 million during the 2025 school year down to $57.5 million in the 2026 one. This cost cutting includes cutting 41 positions over this period (299 positions in 2025 vs 258 in 2026).

MVSD intends to implement a salary freeze over the next two scholar years.

Below I am providing the original disclosure of the above table. The source document is the 2024 - 2025 Second Interim Budget, March 6, 2025.

The MVSD will also cut expenses in other departments.

The mentioned cutting of 41 positions during the next school year combined with the salary freeze over the next two school years appear very challenging. They do not reflect any agreed upon labor union contract with teachers and staff.

The teachers are part of the Mill Valley Teachers Association (MVTA). The latter negotiated with the MVSD a 10% salary increase in the 2024 school year. The MVTA salary increase materially contributed to the reviewed financial crisis in the 2024 school year. One has to be less than confident that the MVTA would agree to 0% salary increase in both the 2026 and 2027 school years.

Thus, the MVSD Turnaround Plan faces material challenges. In summary, several of the underlying assumptions are rather stretched including:

a) Demographic assumption. Average daily attendance over the next several years is likely to continue declining instead of remaining flat.

b) The MVTA is most unlikely to accept a salary freeze over the 2026 and 2027 school years.

Next, let's review the Transitional Kindergarten (TK) situation.

The Transitional Kindergarten (TK) situation

Given the current financial stress the MVSD had cancelled the TK program. TK costs $2.2 million to cover 150 children. That comes out to $14,666 per child. As a reminder this is not the first time the MVSD had cancelled the TK program under financial stress. It did that back in 2019.

MVSD reinstated the program for the following 2026 school year when parents raised $1.5 million in just a few weeks. The MVSD was asking $14,000 per family which was close to the MVSD actual cost per child. MVSD agreed to fund the $700,000 difference through additional cost savings.

$2.2 mm - $1.5 mm = $0.7 mm

The mentioned herculean donation effort is not a sustainable source of funds to sustain TK.

So, what is TK's prospect?

Well first there are positive legislative developments. AB 1391 is currently working its way through the California legislature. If approved, I gather it could be in place for the 2027 school year (starting in the Fall of 2026). AB 1391 would have the State support all TK programs equally regardless of a school district's classification. Right now, the MVSD is a Basic Aid District that receives no State financial support for a TK program. If AB 1391 passes, it would receive State financial support just as if it was a Non-Basic Aid District.

The State of California has its own financial stress, so it is challenging to evaluate the likelihood of AB 1391 passing.

Otherwise, if AB 1391 does not pass, it will have to raise another parcel tax. To do that it could follow two different paths.

- Put the parcel tax directly on an upcoming ballot. It would require 66.6% voting approval to pass.

- Put the parcel tax on an upcoming ballot as a citizen initiative. In such a case, it would require just a simple majority. However, the community (not the MVSD) would have to gather signatures equal to 5% of the voters within the MVSD. I understand there are 23,862 voters within the MVSD, including 7,397 Seniors who could file a parcel tax exemption. Thus the community would have to gather 1,193 signatures.

23,862 x 5% = 1,193

Historically, the community has been pretty supportive of MVSD school fundings through school bonds and parcel taxes. Since 2003 only one parcel tax failed out of 6 funding proposals including parcel tax and school bonds.

Given the national economic shocks triggered by the White House Administration, it is challenging to evaluate how open the wallet of local voters are. But, there are a couple of things to keep in mind.

First, a dynamic campaign to support TK may allow a parcel tax to succeed with a 66.6% requirement. This is because 36% of Marin County residents are renters. And, 31% of MVSD voters are Seniors who can file for parcel-tax exemption. Thus, most probably over 50% of the MVSD voters are not directly affected by the parcel tax. Given that, it would be easy to get their support for TK at no direct cost to them. Next, among the homeowners who are not Seniors, well there are quite a few parents with young children who would benefit from TK programs over the next several years. And, the grandparents of such families and other friends and relatives would be in favor too.

Renters + Seniors + Parents > 66.6%

Next, let's explore the citizen initiative path. Ok, the simple majority bit is a slam dunk. The challenge is the gathering of close to 1,200 signatures. But, it can be met with a solid group of signature-gatherers.

30 gatherers x 40 signatures each = 1,200

40 x 30 = 1,200

50 x 24 = 1,200

The more gatherers you have, the easier the challenge. I personally like the last scenario of 50 gatherers collecting 24 signatures each. This seems to be pretty doable.

THE END